Tax Residence in Uruguay

Benefits and Ways to Otain It Uruguay has updated its tax residence regime through three recent normative changes. On the one hand, two new ways have been established to obtain…

Benefits and Ways to Otain It Uruguay has updated its tax residence regime through three recent normative changes. On the one hand, two new ways have been established to obtain…

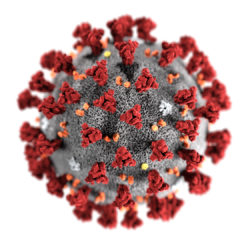

COVID-19 Experience in Latin America: We have witnessed that pandemic of COVID-19 has triggered a health, economic and social crisis with worldwide effects. Social distancing and the generalized use of…

There is no excerpt because this is a protected post.

The Andersen Labour Law team (EMPLAW) in Latin America issued the following publication on Minimum Wage applicable in 2021, as well as the values in some countries for 2022.

Based on Circular No. 3,689, of December 16, 2013, from the Central Bank of Brazil – BACEN, Brazilian companies with foreign capital have until March 31, 2021, to issue a…

Following its rapid expansion in Africa, Andersen Global is now unifying its African member firms under the brand “Andersen.” As part of this transition, five former collaborating firms will become…

We inform that Companies, whether incorporated as Private Limited or as Joint Stock, must approve the accounts presented by their directors annually, within the first four months following the end…

The Ministry of Economy confirmed the possibility of paying in share capital with cryptocurrency (or digital/virtual currencies), in response to a JUCESP consultation.

Read more.

In order to consolidate the strategic ties between Brazil and Chile, both countries signed on July 24, 2020 a Memorandum of Understanding aimed at bilateral cooperation in the area of…

Andersen Global further expands its regional coverage in East Africa through a Collaboration Agreement with Berhane Gila-Michael and Associates, the oldest and largest law firm in Eritrea. Founded in 1947…